cryptocurrency tax calculator ireland

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains. Depending on your tax bracket for ordinary income tax purposes long-term capital gains which.

Pin By Kelly Cashin On Dhs Shopping

In Australia you are required to record the value of the cryptocurrency in your local currency at the time of the transaction.

. BitStamp is one of the worlds largest and most well-known Bitcoin exchanges. Tax on cryptocurrency trading. While cryptocurrencies are not legal tender in Ireland an investment in them is subject to taxation.

In Ireland income tax on crypto activities typically involves getting Paid in. The amount you have to pay in taxes will depend on the duration you hold your crypto. Direct tax treatment of cryptocurrencies.

However even if youre sure that no tax will be due you still need to file a tax return. With the standard CGT rate of 33 the amount of tax you will have to pay will be 730 x 033 24090. And when it comes to making a gain on a cryptocurrency the Revenue guidance states that individuals will be subject to capital gains tax at a rate of 33 per cent on gains while.

Therefore individuals that are trading in cryptocurrency are required to file an income tax return Form 11 or Form 12 each year and declare profits made on trading. In Ireland crypto investments are treated just like investments in stocks or shares. 13 Capital Gains Tax CGT on chargeable gains individuals.

Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you. How is crypto tax calculated. The direct taxes are corporation tax income tax and capital gains tax.

The first one and the easiest and most reliable is connecting your exchange or wallet through an API key or public address. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. Revenues view is that an investment in cryptocurrency is the same as a share.

Crypto tax calculators work in several ways. Defined accounts for tax purposes cannot be prepared in cryptocurrencies. Cryptocurrency Tax Calculator Ireland.

There are no special tax rules for cryptocurrencies or crypto-assets. Fortunately the first 1270 of your cumulative annual gains after deducting expenses and losses from other cryptocurrency investments further details below are exempt from. Document created in May 2018.

You then deduct your personal exemption to find your taxable gain which is 2000 - 1270 730. Deposits can be made through bank transfer SEPA transfer international bank wire and now. How do I calculate tax on crypto to crypto transactions.

May 24 2022. Extract from Revenueie click here for source document. Enter your states tax rate.

In other words if youre making profits or losses through the disposal of your cryptocurrency. Therefore individuals that are trading in cryptocurrency are required to file an income tax return form 11 or form 12 each year and declare profits. Your chargeable gain is therefore 3000 - 1000 2000.

As with any other activity the treatment of income received from charges. Euro or functional accounts must be prepared. Irelands Revenue states that profits and losses of a non-incorporated business on cryptocurrency transactions must be reflected in their accounts and will be taxable on normal income tax rules.

Log In Sign Up. 2 How and when you need to pay. See Taxation of crypto-asset transactions for guidance on.

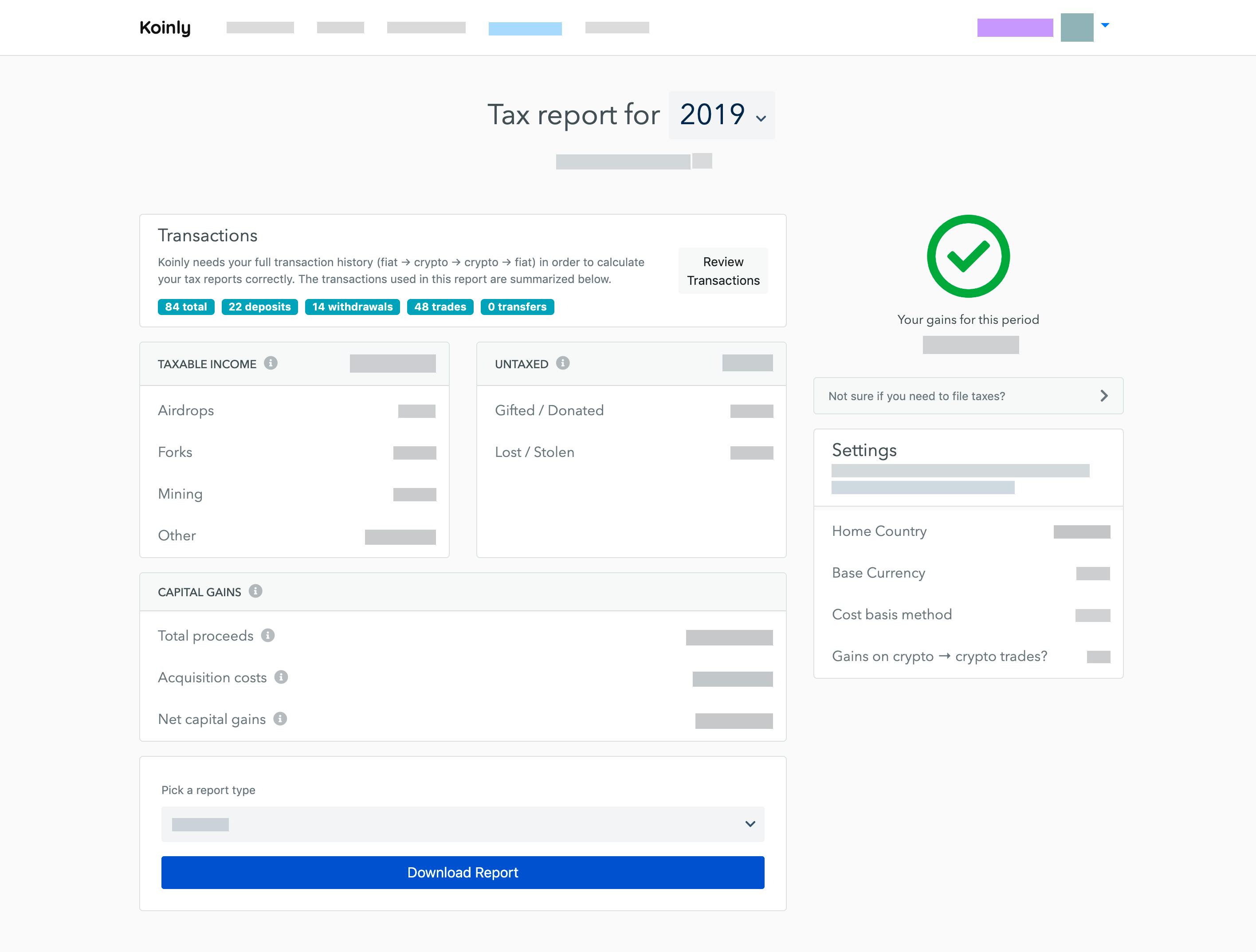

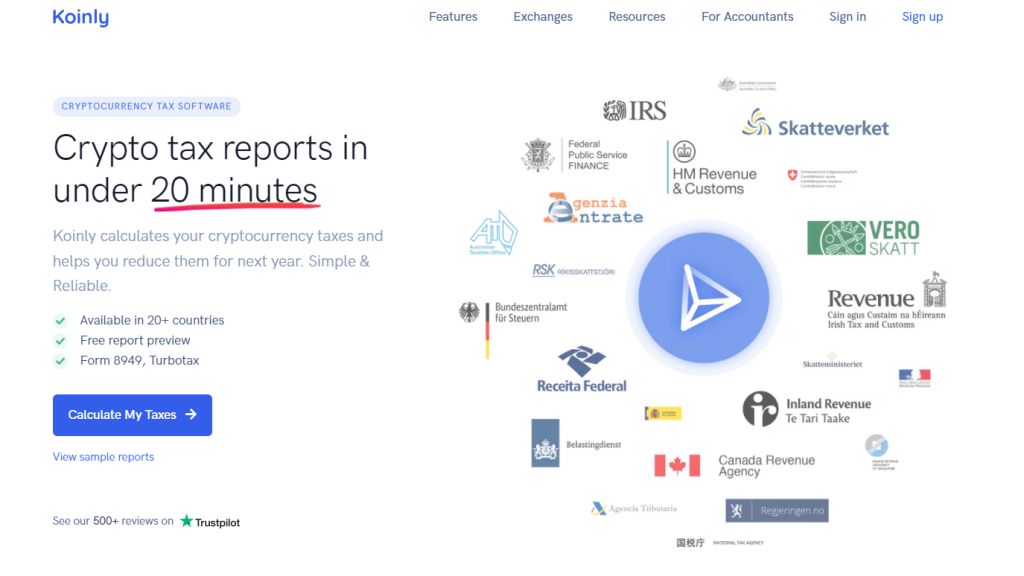

Automate your crypto tax calculation with the best Bitcoin tax calculator. Taxation of cryptocurrency transactions. Only the amount over and above 1270 is subject to 33 tax.

If you are making a profit through the selling gifting or exchanging of your cryptocurrency you need to declare it to Revenue for capital gains tax CGT. Cryptocurrencies and crypto-assets. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances.

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Ultimate Bitcoin Tax Guide 2022 Koinly Crypto Tax

Find The Best Crypto Tax Software For Reporting Your 2021 Taxes

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

How To Calculate Crypto Taxes Koinly

Today Marks The 2nd Anniversary Of Chinas Bitcoin Ban What Has Changed Bitcoin Cryptocurrency Capital Gains Tax

Crypto Tax Calculator Doing Your Crypto Taxes Has Never Been Easier Boinnex

Google Bans Cryptocurrency Mining Apps From Play Store Google Play Store Cryptocurrency App

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Koinly Vs Cointracking Which Crypto Tax Tool Is Better

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Koinly Vs Coinledger Io Ex Cryptotrader Tax Which Tax Calculator Is Better Captainaltcoin

Ireland Cryptocurrency Tax Guide 2021 Koinly

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Ireland Cryptocurrency Tax Guide 2021 Koinly

Ireland Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda